-

- Home

- Personal

- Business & Corporate

- Diaspora

- Treasury

- Platinum Pavilion

- Housing Projects

- About Us

- POS Locations

- Branches and ATMs

- Contact Us

We are thrilled to present our NBS Glaudina Flats, an unparalleled investment opportunity for you to forge an everlasting legacy. Committed to fulfilling your aspirations of property ownership, our brand-new development is under construction, designed to surpass your expectations, and provides exceptional features that will instill a sense of pride and security.

Key Investment Highlights:

Manageable Deposit: Secure your investment with a reasonable 40% down payment.

Competitive Interest Rate: Take advantage of a lucrative 15% interest rate that ensures affordability and financial stability.

Flexible Tenure: 5 years tenure.

This outstanding opportunity should not be overlooked. Contact us today to gather comprehensive information about Glaudina Flats and embark on an extraordinary journey towards real estate investment.

Reach out to us on: 0778 167 167 or 0772 565 555.

We understand that acquiring your dream property involves more than just the physical asset. Therefore, our seasoned Senior Public Relations Specialist, Kevin Mwenye, is devoted to expertly guiding you through every step of the investment process. To gain an in-depth understanding of the remarkable investment opportunity that awaits you, we invite you to watch our informative video showcasing Glaudina Flats https://youtu.be/iIssXUxle70.

Prepare to be captivated as you catch a glimpse of our magnificent development. We cannot wait to welcome you onboard as a valued investor for your dream property. Together, let us embark on a authentic journey toward affordable and high-quality housing solutions tailored to meet your needs.

Understanding the Implications of Money Laundering including Illegal Dealing in Foreign Currency

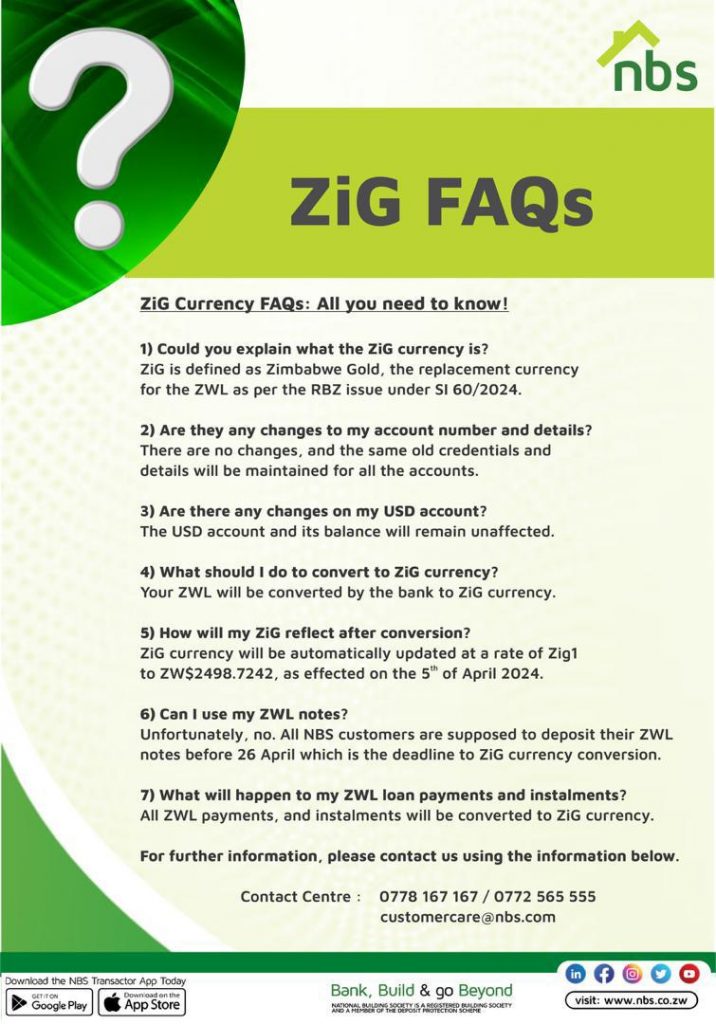

ZiG FAQs

To all our stakeholders and valued customers, stay informed about the new ZiG currency with this update on responses to frequently asked questions (FAQs) about the conversion to ensure a hassle-free adjustment period.

Contact us for any further questions:

Contact Centre:

0778167167 | 0772 565 555

customercare@nbs.co.zw

As NBS, the fast-growing building society in Zimbabwe, we are excited to reflect & stamp our mandate and footprint in the market with our strong rising presence in housing delivery strengthened by our new projects currently selling on the market such as our projects in Glaudina, Tynwald, Borrowdale in Harare and Batanai in Chinhoyi as well as the upcoming Plumtree project. We are truly excited about our engagement with our individual, public, and private stakeholders. This going forward signifies a changing narrative on authentically contributing to the National Housing stock emphasising on affordable housing solutions and access to finance, thus empowering more people to achieve their homeownership dreams which is what we stand For in 2024 and Beyond.

Through commitment, courage, creativity, and caring, we have projected to further extend our influence, not only by deepening our geographical footprint but also by enhancing offerings in housing finance. This move which is part of our mandate to provide valuable opportunities for affordable housing, aimed at bridging the gap and ultimately contributing to the growth of all our stakeholders and clients from all walks of life. Furthermore, we aim to strengthen our corporate promise, reinforcing our commitment to providing sustainable housing solutions and financial services to a broader demographic while focusing on our vision of being your preferred provider of affordable housing and financial services by 2030. Going forward, we are truly excited about our engagement with our individual, public and private stakeholders. This signifies a changing narrative on bridging the gap for individuals aspiring and looking for affordable housing solutions.

We are pleased to advise the introduction of our NBS Funeral Cash Plan (FCP). This insurance product gives peace of mind by providing an immediate lump sum cash payout upon the death of a beneficiary.

You can get USD1,000 tax-free paid out within 24 hours of notifying us of the death of a beneficiary, irrespective of the cause of death. What’s more, there are no restrictions on how you use the money, for example, to buy groceries, to cover hospital bills, to purchase a tombstone or to pay school fees and rentals.

The launch of our NBS FCP is set to empower people to prepare for the future, whether you are an NBS client or non-account holder. There are no medical requirements to be met to sign-up for this product, which is offered in partnership with Fidelity Life Assurance. Cover starts from USD1 per month, per person and it is instant, upon payment of premiums.

The product is also flexible, offering beneficiaries the option to get Funeral Services from Fidelity Life Funeral Services, at affordable rates, in lieu of the cash payout. In addition, when needed, there is a grace period for non-payment of premiums.

The NBS FCP empowers by preparing for life’s eventualities.

National Building Society (NBS) is on an aggressive drive to ensure financial inclusion for all Zimbabweans across the country. We are taking our brand to the people, giving individuals and businesses access to appropriate, affordable, and timely financial solutions.

Banking On The Wheels is being conducted as a roadshow, with NBS visiting the homes, business spaces, and social areas of target beneficiary groups. People can expect exciting engagements, including live musical and dancing performances. Over and above this, we are giving valuable information about NBS to the public and educating people on the various ways that we can put a roof over your head. Prospective customers can also open bank accounts, such as the NBS Insta-Save with no frills, the Ahoyi for tertiary students and the Easy Transact for civil servants. What’s more, there are fantastic prizes to be won!

NBS is especially targeting Zimbabweans in the informal sector, civil servants, students, and low-income earners. Therefore, Banking On The Wheels has been activated in areas such as Mbare, Chitungwiza and Highfields in Harare as well as in the Central Business Districts of Bulawayo, Mutare and Gweru. All the activations are taking place in high-traffic areas throughout the country, namely by healthcare facilities, within industrial areas, and at farms – in the Lowveld NBS currently has a team operating.

Look out for the buzz and opportunities available when NBS Banking On The Wheels comes to your area.

Over the past weekend, the 2023 Interbank Games were in full swing and the National Building Society (NBS) fielded several teams in an array of sports disciplines, including football, volleyball, athletics, pool, and lots more, during an epic event that saw bankers interacting with each other in friendly rivalry.

Employees took time out to showcase their athletic prowess and lifted the NBS flag high. The teams demonstrated high-energy and played commendably, with the pool and chess teams deserving special recognition for their remarkable performances.

The action was also intense as supporters gave their colleagues encouraged and after the sporting activities, staff got to socialise and enjoy the festivities. On and off the field, NBS displayed great spirit as a single team, with a single mission and soul.

It is here; our exciting and improved NBS Hospital Cash plan (HCP)!

What is it?

This insurance package provides financial relief and peace of mind when one is hospitalized.

NBS account holders (employees and customers) can benefit from a USD cash payout when hospitalized following illness or an accident.

In collaboration with Champions Insurance, the NBS HCP has been specifically designed to provide a lump sum cash payout upon hospitalization which is calculated daily and paid out to the insured person for the number of days spent in the hospital.

What are the benefits?

The stress and anxiety that come with being admitted into the hospital is eased, knowing that for as little as USD1 per month, USD100 will be paid for each day spent in the hospital after the first 48 hours of admission.

You also get to:

Having The Hospital Cash Plan will enable you to keep a healthy body and a healthy wallet!

The official launch of NBS Corporate and Institutional Banking (CIB) took place on Friday 5 May 2023.

The launch involved a Golf Tournament during the day and a Cocktail later on, at which the Governor of the Reserve Bank of Zimbabwe (RBZ), Dr. J. P. Mangudya will be the Guest of Honour, ably represented by Mr. Phillip T. Madamombe, RBZ Director of Bank Supervision.

The inauguration of our CIB Unit will provide a platform for business networking while firmly positioning NBS as a capable financial services provider with the capacity to deliver 360-degree solutions for blue-chip companies, parastatal institutions, and the government.